Retail Challenges Are Structural, Not Cyclical

The retail industry continued to face challenges in the first quarter of 2018 (Q1 2018), even as strong economic fundamentals from 2017 carried over. The U.S. unemployment rate has remained unchanged from October 2017 through March 2018 at a low 4.1%, and competition for both skilled and unskilled workers is putting upward pressure on wages. Consumer confidence reached a new 18-year high in February 2018, driven primarily by the strong job market. Although the consumer confidence index dipped slightly in March 2018—breaking a two-month growth trend—it remains at a historically high level indicating future growth. These consumer metrics are all positive signs for a strong retail market.

The first quarter of any year is traditionally when retail closure announcements accelerate. Q1 2018 was no exception, despite the strongest holiday shopping season since the Great Recession. While sifting through stories about bankruptcy and closure announcements and what the future holds for retail, there are two important things to keep in mind. First, perception is worse than reality; not all of the news is negative. There are certainly sectors of retail that are growing. Expansion announcements are happening at the same time that closure news is breaking, they just don’t garner as much attention. Second, the issue is not about consumers not spending money; rather it is the radical shift in how they are spending it. In addition to the acceleration of eCommerce, the nation’s overbuilt retail marketplace is competing with shifting consumer spending patterns—Americans have become more value-conscious, and younger generations are placing more importance on experiences than commodities.

There is a definite wave of consolidation cycling through the retail marketplace. So far this year, eight major retailers filed for bankruptcy, on pace with our projection of 30 bankruptcy announcements in 2018 as a whole. Not all of these filings are the result of irrelevance in the current market or eCommerce disruption. Over the past 20 years, there has been an increase in the number of private equity groups borrowing money to acquire retailers and then putting that debt on the retailer balance sheets. These leveraged buyouts are the cause of many of the latest bankruptcies, including Toys R Us, Bon Ton and Claire’s.

There were nearly 8,500 store closures in 2017, surpassing the number that occurred during the Great Recession. Closures in 2018 are expected to match or exceed that level. Announced store closures have reached approximately 4,500 year to date; Cushman & Wakefield estimates that this figure will reach over 9,000 this year. The top retail categories in contraction mode are: consumer electronics, apparel, department stores, media (books/music/video) and sporting goods, most of which are typically tied to mall or power center locations. At the same time, we are tracking expansion announcements of 5,000 units so far this year, and our estimates for future expansions also top 9,000 units for all of 2018. Top expansion categories include: dollar stores, discount grocery, off-price apparel, beauty/cosmetics, fitness/health clubs, mass merchandisers (smaller footprints), fast food, coffee and fast fashion, most of which operate in neighborhood and community centers.

Effect On Mall vs. Non-mall Assets

As closure announcements gain momentum, the gap in performance between mall classes will widen. Class A malls will continue to attract tenants. In fact, anchor closures at trophy or class A malls present opportunities for landlords to attract new, more relevant tenants such as food halls, experiential concepts or other trendy new retailers at current rents. Landlords will also see non-traditional mall tenants such as discounters, off-price or grocery chains move into some of these vacancies. Tenants that have been traditionally power center based will increasingly look to class B malls as an option, and definitions of center types based on tenant mix will begin to blur. Class C malls will not survive, and closures will increase in 2018 and gain momentum through 2020.

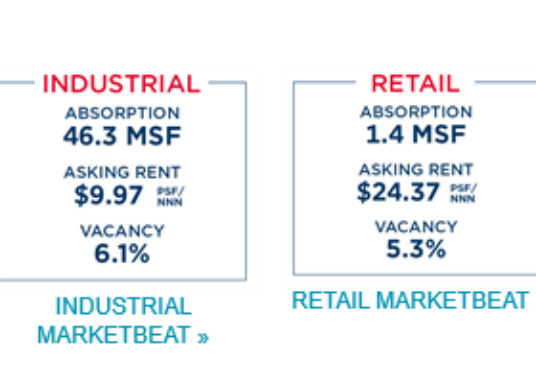

Non-mall statistics continue to trend positive, yet the quarterly gains have slowed. Net absorption was positive in Q1 2018, although the 4.8 million square feet (msf) absorbed is only about half of the quarterly average registered over the past three years. Vacancy across non-mall shopping centers declined 10 basis points (bps) to 6.6% in Q1 2018, down from 7.0% in the first quarter of 2017. Neighborhood and community centers ended the first quarter of 2018 with a combined vacancy rate of 7.3%, a decline of 40 bps from one year prior. Power center vacancy dropped below the 5% threshold in Q1 2018, despite looming vacancies from retail consolidations which may start in the second quarter of the year. Neighborhood and community centers may also face closures as Walgreens aims to close 600 redundant locations over an 18-month period resulting from its acquisition of more than 2,000 units from Rite Aid in 2017. Rent concessions are up, particularly in class B and C centers, as landlords strive to keep lease rates in place. Diminished construction activity will help keep vacancy rates stable amid anticipated consolidation activity. Nearly 4.0 msf was delivered to the non-mall shopping center inventory in Q1 2018, compared to the 6.2 msf quarterly average delivered over the past three years. Only 15.5 msf remains under construction, the lowest level seen in more than 10 years.

Topping the list of closures is Toys R Us with a complete liquidation of its U.S. locations, 20% of which are owned by the retailer. Approximately 180 Source: CoStar, Cushman & Wakefield Research

stores closed in the first quarter of 2018, and Toys R Us is in the process of closing the remaining 740. Approximately 20% of the stores were in urban locations, another 30% in malls and lifestyle centers, and the remaining 50% of stores within power centers. The good news is that nearly the entire portfolio is located in class A properties—which remain in high demand—so the vacated spaces are well positioned to be backfilled quickly. With footprints between 25,000 to 35,000 square feet (sf), these locations are an ideal fit for off-price apparel and smaller format grocery stores, both of which are strong growth categories. These locations may also appeal to mass merchandisers looking to downsize to mid-size boxes, such as Target which is aiming to open 30 new stores this year in that size range primarily in urban or denser populated suburban areas. Kohl’s also intends to ramp up expansion plans for smaller format stores, even as it closes underperforming larger ones and experiments with partnering with Aldi in an initial ten locations creating a store-within-a-store concept.

What eCommerce Growth Means for Bricks and Mortar

Given the acceleration of online sales, it is easy to point to eCommerce as a key pressure point that retail is feeling. Preliminary data released in February 2018 from the U.S. Department of Commerce show that eCommerce sales grew 16.9% from the fourth quarter of 2016 to the fourth quarter of 2017; total retail sales grew 5.7% over that same period. However, eCommerce only accounts for 9.1% of total retail, a figure which went unchanged from third quarter 2017 to year-end 2017. While online sales are anticipated to reach 12% of total retail sales by the end of 2020, the majority of sales is still in bricks and mortar retail. In fact, studies show that consumers continue to look for physical retail stores even when shopping online. A seamless omni-channel strategy is crucial in the current environment to engage customers and build brand awareness.

Clicks-to-bricks growth will continue this year. Concepts that started as Internet-pure play retail recognize the benefits of interacting with their customers at physical locations, and have realized that opening a new bricks-and-mortar store will yield a 20%-40% increase in online sales in that market.

eGrocery will continue to ramp up in 2018. The Amazon/Whole Foods merger in 2017 was a game-changer for grocery and logistics. Traditional grocers will look to boost their online offerings to compete, including partnering with complementary concepts such as prepared meal-kit companies. While chains are feeling the disruption, eGrocery growth does not pose as much of a threat to commercial real estate. Industrial acquisitions and new warehouse spaces built close to urban areas is too expensive and it is difficult to find suitable real estate. When ramping up eGrocery businesses, it makes more sense to utilize existing grocery store locations within a mile or two of the customer base to manage proper handling of perishable goods and final mile delivery costs.

eCommerce will continue becoming increasingly involved with certain retail categories, such as high-end fashion and accessories, furniture and ePharma. Still, some categories will remain more eCommerce proof.

OUTLOOK:

- M&A activity will skyrocket in 2018.

- Omni-channel strategy remains crucial for retailers to engage customers and build brand awareness.

- Offering an experience still reigns supreme in the current retail landscape.

- Shopping centers will move away from traditional tenant mixes.

- The gap will widen between mall classes. Class A will see opportunity in anchor closures to bring in new concepts at current market rents. Class B will look at non-traditional mall tenants and innovation to survive. Class C malls will not survive.

- Closures of weakest malls and centers will ramp up in the second half of 2018. The reinvention of these dying malls as mixed-use projects will gain momentum in 2019 and beyond.